What Affects Mortgage Loan Rates: 7 Powerful Factors Revealed

Ever wondered what affects mortgage loan rates and why they change so often? You’re not alone. Understanding the forces behind your home loan interest can save you thousands over time—let’s break down the real reasons behind the numbers.

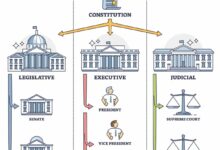

What Affects Mortgage Loan Rates: The Big Picture

:max_bytes(150000):strip_icc()/factors-affect-mortgage-rates_final-e70ed5b382434255928bf3246b6f4b8f.png?w=1200)

When you’re shopping for a home loan, one of the first things you’ll notice is that mortgage rates fluctuate—sometimes daily. But what drives these changes? The answer isn’t just about your credit score or down payment. A complex web of economic, financial, and personal factors shapes the rate you’re offered. Understanding what affects mortgage loan rates is crucial for making informed decisions and securing the best possible deal.

Mortgage rates are influenced by both macroeconomic forces—like inflation, Federal Reserve policy, and bond markets—and micro-level factors such as your credit history, loan type, and down payment. To truly grasp what affects mortgage loan rates, we need to explore both the broad economic landscape and the personal choices that lenders evaluate when setting your interest rate.

The Role of the Bond Market

One of the most significant yet misunderstood influences on mortgage rates is the bond market—specifically, the yield on the 10-year Treasury note. While the Federal Reserve doesn’t directly set mortgage rates, its monetary policy affects investor behavior, which in turn impacts bond yields.

When investors are nervous about the economy, they often flock to safe-haven assets like U.S. Treasury bonds. This increased demand drives bond prices up and yields down. Since mortgage-backed securities (MBS) compete with Treasuries for investor attention, lower Treasury yields typically lead to lower mortgage rates. Conversely, when the economy is strong and inflation fears rise, bond yields climb, pushing mortgage rates higher.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

According to the Federal Reserve, mortgage rates often follow the 10-year Treasury yield with a spread of about 1.5% to 2%, depending on market conditions.

“Mortgage rates are not set by the Fed directly, but by the secondary mortgage market, where loans are bought and sold.” — Federal Reserve Bank of St. Louis

Inflation and Its Impact on Rates

Inflation is one of the most powerful forces shaping what affects mortgage loan rates. Simply put, lenders want to ensure that the money they lend today will be worth roughly the same when it’s paid back over the next 15 or 30 years. If inflation rises, the purchasing power of future repayments decreases, so lenders compensate by charging higher interest rates.

For example, if inflation is running at 4% annually, a lender offering a 5% mortgage rate is only earning about 1% in real return. To maintain profitability, they may push rates up to 6% or 7%. The U.S. Bureau of Labor Statistics tracks inflation through the Consumer Price Index (CPI), and spikes in CPI often precede increases in mortgage rates.

Historically, periods of high inflation—like the late 1970s and early 1980s—saw mortgage rates soar above 15%. Today, the Federal Reserve targets a 2% inflation rate, which helps keep long-term rates stable. But when inflation exceeds this target, as it did in 2022 and 2023, rates respond quickly.

- Inflation erodes the value of fixed repayments over time.

- Lenders raise rates to preserve real returns.

- Market expectations of future inflation matter as much as current data.

How the Federal Reserve Influences Mortgage Rates

While the Federal Reserve doesn’t set mortgage rates directly, its policies have a profound indirect effect on what affects mortgage loan rates. The Fed’s primary tool is the federal funds rate—the interest rate at which banks lend to each other overnight. This rate influences short-term borrowing costs across the economy.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

When the Fed raises the federal funds rate to combat inflation, it becomes more expensive for banks to borrow money. As a result, they pass those costs on to consumers through higher interest rates on credit cards, auto loans, and adjustable-rate mortgages (ARMs). While fixed-rate mortgages are more tied to long-term bond yields, they still respond to shifts in monetary policy.

For instance, during the 2022–2023 period, the Fed raised rates aggressively to cool inflation. Though the federal funds rate primarily affects short-term rates, the broader tightening of monetary policy led investors to expect higher inflation control, which initially pushed mortgage rates up as bond yields rose.

Federal Reserve Rate Hikes and Market Expectations

Markets are forward-looking. Even before the Fed makes a move, mortgage rates can shift based on expectations. If investors believe the Fed will raise rates in the coming months, they may sell bonds in anticipation, causing yields to rise and mortgage rates to follow.

This phenomenon was evident in 2021, when inflation began to climb and speculation grew about Fed tightening. Despite no immediate rate hikes, 30-year mortgage rates rose from below 3% to over 3.5% in just a few months. By the time the Fed began hiking in 2022, rates had already started their upward trend.

The Investopedia explains that mortgage rates often anticipate Fed actions by several months, making market sentiment a critical component of rate forecasting.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

Quantitative Easing and Mortgage-Backed Securities

Another way the Fed influences mortgage rates is through its purchase of mortgage-backed securities (MBS). During economic downturns, such as the 2008 financial crisis or the 2020 pandemic, the Fed has bought billions of dollars in MBS to inject liquidity into the housing market.

By increasing demand for MBS, the Fed drives up their prices and lowers their yields, which translates into lower mortgage rates. This policy, known as quantitative easing (QE), was a major factor in keeping 30-year fixed rates below 3.5% for much of the 2010s and early 2020s.

However, when the Fed reverses course and begins selling or allowing MBS to mature without reinvestment (quantitative tightening), the opposite happens: MBS yields rise, and mortgage rates increase. This dynamic was clearly seen in 2022 when the Fed began reducing its balance sheet, contributing to a rapid rise in mortgage rates.

“The Fed’s MBS purchases during the pandemic helped keep mortgage rates near historic lows.” — Federal Reserve Economic Data (FRED)

What Affects Mortgage Loan Rates: Economic Indicators

Beyond the Fed and inflation, several key economic indicators help determine what affects mortgage loan rates. These data points are released regularly and are closely watched by investors, lenders, and economists. Understanding them can give you insight into where rates might be headed.

Lenders and investors use these indicators to assess the health of the economy and anticipate future inflation and growth. Strong economic data can push rates up, while weak data may lead to lower rates as investors seek safer assets.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

Employment Data (Non-Farm Payrolls)

One of the most influential reports is the monthly Non-Farm Payrolls (NFP) report, released by the U.S. Bureau of Labor Statistics. It shows how many jobs were added or lost in the previous month, excluding farm workers, private household employees, and nonprofit employees.

Strong job growth signals a robust economy, which can lead to higher consumer spending, wage growth, and inflationary pressures. As a result, investors may expect the Fed to raise rates, pushing mortgage rates upward. Conversely, weak job numbers can lead to lower rates as markets anticipate slower growth and potential rate cuts.

For example, in early 2023, stronger-than-expected job reports caused mortgage rates to jump by 0.25% in a single week. Traders interpreted the data as a sign that inflation would remain sticky, reducing the likelihood of near-term Fed rate cuts.

- Strong NFP = higher inflation expectations = higher mortgage rates.

- Weak NFP = lower growth outlook = lower mortgage rates.

- Markets react within hours of data release.

GDP Growth and Consumer Spending

Gross Domestic Product (GDP) measures the total value of goods and services produced in the economy. When GDP grows rapidly, it often leads to higher demand for credit and inflationary pressures, both of which can push mortgage rates up.

Consumer spending, which makes up about 70% of GDP, is particularly important. High spending can drive inflation, especially if supply chains are strained. The Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge, is closely tied to consumer behavior.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

For instance, during the post-pandemic recovery in 2021, pent-up consumer demand led to a surge in spending on goods and services. This contributed to inflation and, eventually, higher mortgage rates as the Fed signaled a shift toward tighter monetary policy.

According to the Bureau of Economic Analysis, GDP growth above 3% annually often coincides with rising interest rates.

What Affects Mortgage Loan Rates: The Housing Market Itself

The state of the housing market plays a crucial role in determining what affects mortgage loan rates. Supply and demand dynamics, home price trends, and housing starts all influence lender behavior and investor sentiment.

When home prices rise rapidly, lenders may perceive greater risk in the housing market, especially if affordability becomes strained. This can lead to tighter lending standards and higher rates to compensate for potential defaults. Conversely, a cooling market may prompt lenders to lower rates to stimulate demand.

Home Price Appreciation and Affordability

Rapid home price growth, as seen in 2020–2022, can indirectly affect mortgage rates. While rising prices don’t directly cause rate hikes, they contribute to inflation metrics and reduce housing affordability.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

When homes become less affordable, fewer buyers can qualify for loans, which reduces demand. To attract more borrowers, lenders might offer lower rates or more favorable terms. However, if price growth is driven by strong demand and low inventory, lenders may keep rates stable or even raise them, expecting continued market strength.

The S&P CoreLogic Case-Shiller Index tracks home price trends across major U.S. cities. According to S&P Global, national home prices rose over 19% year-over-year in 2021, contributing to inflation and influencing monetary policy.

Housing Inventory and Construction Activity

Low housing inventory creates a seller’s market, where competition drives prices up. This can lead to higher mortgage rates as lenders anticipate strong demand and potential inflation.

Conversely, when new construction increases and inventory rises, the market balances out. Builders may offer incentives, and lenders might lower rates to attract buyers. The U.S. Census Bureau tracks housing starts and building permits, which are leading indicators of supply trends.

For example, in 2023, rising mortgage rates slowed home buying, but low inventory kept prices elevated. This paradox made it harder for the Fed to cool inflation, prolonging high-rate environments.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

“Low inventory has been a persistent issue, keeping upward pressure on home prices and indirectly influencing mortgage rates.” — National Association of Realtors (NAR)

What Affects Mortgage Loan Rates: Lender Competition and Market Structure

While macroeconomic factors set the baseline, the actual rate you receive depends heavily on the competitive landscape among lenders. Banks, credit unions, mortgage brokers, and online lenders all compete for your business, and their pricing strategies can vary significantly.

Understanding how lender competition affects rates can help you shop smarter and save money. Even small differences in rate or fees can add up to tens of thousands of dollars over the life of a loan.

How Lender Type Influences Rates

Traditional banks, such as Chase or Bank of America, often have higher overhead costs and may offer slightly higher rates. Credit unions, being member-owned and nonprofit, sometimes offer lower rates and fees.

Online lenders like Rocket Mortgage or SoFi have lower operating costs and can pass savings to borrowers. Mortgage brokers act as intermediaries, shopping your loan to multiple lenders to find the best rate.

A 2023 study by NerdWallet found that borrowers who compared at least five lenders saved an average of 0.25% on their mortgage rate—equivalent to $50,000 in savings on a $300,000 loan over 30 years.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

Rate Locks and Timing Strategies

Lenders offer rate locks, which guarantee your interest rate for a set period (usually 30 to 60 days) while your loan is processed. This protects you from rate increases during closing.

However, rate locks come with risks. If rates fall after you lock, you may not be able to benefit unless you pay to extend or re-lock. Some lenders offer “float-down” options, allowing you to lower your rate once if market rates drop.

Timing your rate lock is crucial. If you’re buying in a rising rate environment, locking early may be wise. In a falling market, you might wait to see if rates improve.

- Rate locks typically last 30–60 days.

- Extending a lock may cost 0.25% to 0.5% of the loan amount.

- Float-down options add flexibility but may have conditions.

What Affects Mortgage Loan Rates: Your Personal Financial Profile

While economic forces shape the broader rate environment, your personal financial situation determines the rate you’re offered. Lenders assess risk based on several key factors, and even small improvements can lead to significant savings.

Understanding what affects mortgage loan rates on an individual level empowers you to take control of your borrowing costs before you apply.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

Credit Score and Credit History

Your credit score is one of the most critical factors in determining your mortgage rate. Lenders use FICO scores (typically ranging from 300 to 850) to assess your likelihood of repaying the loan.

Borrowers with scores above 760 usually qualify for the lowest rates. Those below 620 may face higher rates or be denied altogether. According to FICO, a borrower with a 760+ score could pay 0.5% to 0.75% less than someone with a 660 score on the same loan.

For a $300,000 mortgage, that difference could save over $300 per month and nearly $110,000 over 30 years. Improving your score by paying down debt, correcting errors, and avoiding new credit inquiries can yield big returns.

Learn more about credit scoring at myFICO.

Loan-to-Value Ratio and Down Payment

The loan-to-value (LTV) ratio compares the loan amount to the home’s appraised value. A lower LTV means you’ve put more down, reducing the lender’s risk.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

For example, a 20% down payment results in an 80% LTV, which typically qualifies you for the best rates and avoids private mortgage insurance (PMI). Borrowers with 90% LTV or higher often pay higher rates and fees.

Putting down 10% instead of 20% might seem minor, but it can increase your rate by 0.25% to 0.5% and add thousands in interest and PMI costs over time.

“Every percentage point in your down payment can reduce your mortgage rate and long-term costs.” — Consumer Financial Protection Bureau (CFPB)

Debt-to-Income Ratio and Employment Stability

Your debt-to-income (DTI) ratio measures your monthly debt payments relative to your gross monthly income. Lenders prefer DTI below 36%, though some programs allow up to 43% or higher.

A high DTI suggests you may struggle to manage mortgage payments, so lenders may charge a higher rate or deny your application. Paying off credit cards or auto loans before applying can improve your DTI and boost your rate.

Employment history also matters. Lenders favor borrowers with stable, verifiable income—especially those in the same field for two years or more. Self-employed borrowers may need to provide additional documentation, which can affect approval odds and rates.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

- DTI below 36% = better rates.

- Stable income = lower perceived risk.

- Self-employed borrowers may face higher scrutiny.

What Affects Mortgage Loan Rates: Loan Type and Term

The type of mortgage you choose has a direct impact on your interest rate. Different loan programs carry different levels of risk for lenders, which is reflected in the pricing.

Understanding the trade-offs between loan types can help you select the option that best fits your financial goals and risk tolerance.

Fixed-Rate vs. Adjustable-Rate Mortgages

Fixed-rate mortgages offer stable payments over the life of the loan—typically 15, 20, or 30 years. Because lenders bear the risk of rising rates, fixed-rate loans usually have higher initial rates than adjustable-rate mortgages (ARMs).

ARMs start with a lower fixed rate for a set period (e.g., 5 or 7 years), then adjust annually based on market indexes. They can be risky if rates rise, but may save money if you plan to sell or refinance before the adjustment period.

For example, a 5/1 ARM might start at 5.5% while a 30-year fixed is at 6.5%. But after five years, the ARM could reset to 7.5% or higher, increasing your payment.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

Government-Backed vs. Conventional Loans

Government-backed loans—like FHA, VA, and USDA loans—are insured by federal agencies, reducing lender risk. As a result, they often come with lower rates and more flexible qualification requirements.

FHA loans require as little as 3.5% down and allow lower credit scores. VA loans, available to veterans, often require no down payment and no PMI. USDA loans offer 100% financing in rural areas.

However, these loans may have additional fees or mortgage insurance premiums that affect the total cost. Conventional loans, while sometimes requiring higher credit and down payments, can offer lower rates for well-qualified borrowers.

More details at HUD.gov.

Loan Term Length and Interest Costs

Shorter loan terms come with lower interest rates but higher monthly payments. A 15-year mortgage typically has a rate 0.5% to 0.75% lower than a 30-year loan.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

While the monthly payment is higher, you’ll pay significantly less interest over the life of the loan. For example, on a $300,000 loan at 5.5%, a 15-year term would save over $150,000 in interest compared to a 30-year term.

Choosing the right term depends on your budget, financial goals, and long-term plans.

- 15-year: lower rate, less interest, higher payment.

- 30-year: higher rate, more interest, lower payment.

- 20-year: middle ground with moderate savings.

What affects mortgage loan rates the most?

The most significant factors are macroeconomic conditions—especially inflation, bond market yields, and Federal Reserve policy. However, your personal financial profile (credit score, down payment, DTI) and loan choice (term, type) also play major roles in the rate you receive.

Do mortgage rates change daily?

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

Yes, mortgage rates can change daily—or even multiple times a day—based on market movements. They are influenced by investor sentiment, economic data releases, and global events.

Can I negotiate my mortgage rate?

You can’t directly negotiate the base rate, but you can shop around, compare lender offers, and ask for a “rate match” or discount points to lower your effective rate. Improving your credit or increasing your down payment can also lead to better offers.

How do I lock in a low mortgage rate?

Get pre-approved, compare multiple lenders, monitor rate trends, and use a rate lock once you’re ready to close. Consider a float-down option for added protection.

what affects mortgage loan rates – What affects mortgage loan rates menjadi aspek penting yang dibahas di sini.

Are mortgage rates the same for everyone?

No. While the “average” rate is widely reported, your actual rate depends on your credit, loan type, down payment, and lender. Two borrowers applying on the same day can receive different offers.

Understanding what affects mortgage loan rates is essential for anyone buying a home or refinancing. From broad economic forces like inflation and Federal Reserve policy to personal factors like credit score and down payment, a wide range of elements shape the interest rate you’ll pay. By knowing these drivers, you can time your purchase, improve your financial profile, and shop smarter. Whether you’re a first-time buyer or a seasoned homeowner, this knowledge empowers you to make better financial decisions and save thousands over the life of your loan.

Further Reading: