Adjustable Mortgage Loan Rates Trends 2024: Shocking Insights

Navigating the world of adjustable mortgage loan rates trends can feel like predicting the weather in a storm. With economic shifts, inflation, and Federal Reserve policies constantly in motion, understanding these trends is crucial for homebuyers and investors alike.

Understanding Adjustable Mortgage Loan Rates Trends

Adjustable mortgage loan rates trends are not just numbers on a spreadsheet—they reflect the pulse of the housing market and broader economy. These rates fluctuate based on a mix of economic indicators, central bank policies, and market sentiment. Understanding them helps borrowers make smarter financial decisions.

What Are Adjustable-Rate Mortgages (ARMs)?

An adjustable-rate mortgage (ARM) is a type of home loan where the interest rate changes over time, typically after an initial fixed-rate period. Unlike fixed-rate mortgages, ARMs offer lower introductory rates but carry the risk of future increases.

- Initial fixed period (e.g., 5, 7, or 10 years)

- Rate adjusts based on a benchmark index plus a margin

- Common types include 5/1, 7/1, and 10/1 ARMs

For example, a 5/1 ARM has a fixed rate for the first five years, then adjusts annually thereafter. This structure appeals to borrowers planning to sell or refinance before the rate resets.

How ARM Rates Are Calculated

The interest rate on an ARM is determined by combining a benchmark index—such as the Secured Overnight Financing Rate (SOFR), which replaced LIBOR—with a lender’s margin. The formula is simple: Index + Margin = Fully Indexed Rate.

- SOFR is now the primary benchmark for most ARMs

- Margin is set by the lender and remains constant

- Rate adjustments are subject to caps (discussed later)

For instance, if the current SOFR is 4.25% and the lender’s margin is 2.5%, the fully indexed rate would be 6.75%. This calculation happens at each adjustment interval.

Why Adjustable Mortgage Loan Rates Trends Matter

Tracking adjustable mortgage loan rates trends helps borrowers anticipate future payments and assess risk. In a rising rate environment, ARMs can become significantly more expensive after the initial period. Conversely, in a falling rate market, borrowers may benefit from lower payments without refinancing.

“ARMs are not inherently risky—they’re tools. The risk comes from misunderstanding how they work.” — Financial Analyst, Mortgage Banking Journal

These trends also influence housing affordability, refinancing activity, and overall market liquidity. As such, they’re closely monitored by policymakers, lenders, and investors.

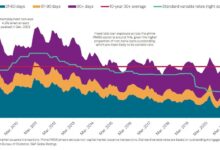

Historical Trends in Adjustable Mortgage Loan Rates

To understand where adjustable mortgage loan rates trends are headed, it’s essential to look back at where they’ve been. Historical data reveals patterns tied to economic cycles, inflation, and monetary policy shifts.

The Rise and Fall of ARMs in the 2000s

During the early 2000s, ARMs gained popularity due to low initial rates and relaxed lending standards. Between 2003 and 2006, nearly 40% of new mortgages were adjustable-rate loans. However, when rates began to rise in 2006–2007, many borrowers faced unaffordable payments, contributing to the housing market collapse.

- Subprime lending fueled ARM growth

- Reset penalties and teaser rates trapped borrowers

- Post-crisis, ARMs lost favor and market share dropped

The 2008 financial crisis served as a cautionary tale, leading to stricter regulations and greater consumer awareness.

ARMs in the Post-Crisis Era (2010–2020)

After the Great Recession, ARMs became less common as the Federal Reserve kept interest rates near zero. Fixed-rate mortgages dominated the market, offering stability and predictability. However, ARMs never disappeared—they evolved.

- Lenders introduced more transparent terms

- Regulatory reforms (e.g., Dodd-Frank Act) improved borrower protections

- ARM share hovered around 5–10% of new originations

During this period, adjustable mortgage loan rates trends were relatively stable, with minor fluctuations tied to short-term rate changes.

Recent Shifts (2021–2023)

As inflation surged in 2021–2022, the Federal Reserve aggressively raised interest rates, pushing both fixed and adjustable rates higher. However, ARMs remained attractive to some borrowers due to lower initial rates compared to 30-year fixed loans.

- In 2022, ARM originations rose to 12% of total mortgages (source: Mortgage Bankers Association)

- Homeowners used ARMs to reduce monthly payments in a high-rate environment

- Investors and house flippers favored ARMs for short-term ownership

By 2023, adjustable mortgage loan rates trends showed increased volatility, reflecting uncertainty about future rate hikes and economic growth.

Current Adjustable Mortgage Loan Rates Trends in 2024

As of 2024, adjustable mortgage loan rates trends are shaped by a complex mix of inflation data, labor market performance, and Federal Reserve guidance. While inflation has cooled from its 2022 peak, rates remain elevated compared to the previous decade.

2024 Rate Environment Overview

As of Q2 2024, the average rate for a 5/1 ARM is around 6.25%, compared to 7.0% for a 30-year fixed mortgage. This 75-basis-point spread makes ARMs appealing for borrowers who don’t plan to stay in their homes long-term.

- Initial ARM rates are 0.5% to 1.0% lower than fixed rates

- SOFR-based indices have stabilized after volatility in 2022–2023

- Lenders are offering more competitive ARM products

According to Freddie Mac, ARM popularity is rising among first-time buyers and those in high-cost markets.

Factors Influencing Current Trends

Several key factors are driving today’s adjustable mortgage loan rates trends:

- Inflation Data: Core PCE and CPI reports directly impact Fed policy decisions.

- Federal Reserve Policy: The Fed’s stance on rate cuts or hikes affects short-term indices like SOFR.

- Housing Market Demand: Low inventory and high prices keep mortgage demand strong.

- Global Economic Conditions: Geopolitical tensions and supply chain issues influence investor sentiment.

For example, if the Fed signals rate cuts in late 2024, ARM rates could decline, making them even more attractive.

Regional Variations in ARM Adoption

Adjustable mortgage loan rates trends vary significantly by region. In high-cost areas like California, Seattle, and Boston, ARMs are more popular due to higher loan balances and shorter expected ownership periods.

- West Coast: Over 15% of new mortgages are ARMs

- South and Midwest: ARM adoption remains below 10%

- Urban markets: Investors use ARMs for rental properties

This regional disparity reflects differences in housing affordability, income levels, and borrower behavior.

How the Federal Reserve Impacts Adjustable Mortgage Loan Rates Trends

The Federal Reserve doesn’t set mortgage rates directly, but its policies have a profound influence on adjustable mortgage loan rates trends. Through open market operations and interest rate decisions, the Fed shapes the broader financial environment.

The Role of the Federal Funds Rate

The federal funds rate is the interest rate at which banks lend to each other overnight. While not directly tied to mortgages, it influences short-term interest rates, including those that underlie ARMs.

- When the Fed raises rates, short-term indices like SOFR tend to rise

- Higher rates increase borrowing costs across the economy

- ARMs with frequent adjustment periods (e.g., 1-year resets) are most sensitive

For example, the Fed’s rate hikes between 2022 and 2023 pushed SOFR from near zero to over 5%, directly impacting ARM rates.

Quantitative Tightening and Mortgage-Backed Securities

Beyond interest rates, the Fed’s balance sheet policies also affect adjustable mortgage loan rates trends. From 2022 onward, the Fed began reducing its holdings of mortgage-backed securities (MBS), a process known as quantitative tightening (QT).

- Reduced MBS demand increases yields, pushing mortgage rates higher

- QT removes a major buyer from the market, increasing volatility

- Lenders pass on higher funding costs to borrowers

According to Federal Reserve data, QT has contributed to a 0.25% to 0.50% increase in mortgage rates since 2022.

Forward Guidance and Market Expectations

The Fed’s communication—known as forward guidance—plays a critical role in shaping adjustable mortgage loan rates trends. When officials signal future rate cuts, markets often react immediately, even before policy changes occur.

- Positive economic data may delay rate cuts, keeping ARM rates elevated

- Recession fears can lead to rate cut expectations, lowering ARM rates

- Market sentiment often moves faster than actual policy

In early 2024, Fed Chair Jerome Powell’s comments about potential mid-year rate cuts caused ARM rates to dip slightly, demonstrating the power of expectations.

Pros and Cons of Adjustable Mortgage Loan Rates Trends

Adjustable mortgage loan rates trends offer both opportunities and risks. Understanding the pros and cons helps borrowers decide whether an ARM is right for their financial situation.

Advantages of ARMs in Current Trends

In today’s market, ARMs provide several benefits:

- Lower Initial Payments: Borrowers save hundreds per month compared to fixed-rate loans.

- Flexibility: Ideal for those planning to sell or refinance within 5–7 years.

- Potential for Rate Decreases: If market rates fall, ARM borrowers benefit automatically.

- Tax and Investment Strategies: Some use ARMs to free up cash for higher-return investments.

For example, a borrower with a $500,000 loan could save over $200 monthly with a 5/1 ARM versus a 30-year fixed, amounting to $12,000 in savings over five years.

Risks and Drawbacks of ARMs

Despite their appeal, ARMs carry significant risks:

- Payment Shock: After the fixed period, rates and payments can rise sharply.

- Uncertainty: Future rate changes are unpredictable, making long-term budgeting difficult.

- Refinancing Risk: If rates rise or credit deteriorates, refinancing may not be possible.

- Index Volatility: SOFR and other indices can fluctuate rapidly.

A borrower who keeps an ARM beyond the initial period could face a payment increase of 30% or more, especially in a rising rate environment.

When an ARM Makes Sense

Adjustable mortgage loan rates trends favor ARMs in specific scenarios:

- Short-term homeowners (e.g., relocating for a job)

- Investors with exit strategies

- Borrowers expecting income growth

- Those in high-cost markets where fixed rates are prohibitive

Financial advisors often recommend ARMs only when the borrower has a clear plan to mitigate rate risk.

How to Navigate Adjustable Mortgage Loan Rates Trends

Successfully navigating adjustable mortgage loan rates trends requires research, planning, and proactive decision-making. Borrowers should not rely solely on current rates but should anticipate future changes.

Monitoring Economic Indicators

Staying informed about key economic data helps predict adjustable mortgage loan rates trends:

- Non-Farm Payrolls: Strong job growth may delay rate cuts.

- CPI and PCE Inflation: High inflation keeps pressure on the Fed to maintain high rates.

- Consumer Confidence: Reflects spending and borrowing behavior.

- 10-Year Treasury Yield: Often moves in tandem with mortgage rates.

Subscribing to economic calendars from sources like Bloomberg or Investing.com can help borrowers stay ahead of trends.

Using Rate Caps to Your Advantage

ARMs come with rate caps that limit how much the interest rate can increase:

- Periodic Cap: Limits rate increases at each adjustment (e.g., 2% per year)

- Lifetime Cap: Sets the maximum rate over the loan’s life (e.g., 6% above initial rate)

- Initial Adjustment Cap: Applies to the first reset after the fixed period

For example, a 5/1 ARM with a 2/6 cap allows a maximum 2% increase per adjustment and a total increase of 6% over the loan’s life. These caps provide a safety net against extreme payment shocks.

Refinancing Strategies in a Volatile Market

Refinancing is a powerful tool for managing adjustable mortgage loan rates trends. Borrowers can switch to a fixed-rate mortgage before their ARM resets, locking in stability.

- Monitor fixed-rate trends and refinance when rates drop

- Build equity to qualify for better terms

- Use home equity loans or cash-out refinancing strategically

However, refinancing costs (typically 2–5% of loan amount) must be weighed against long-term savings. A break-even analysis is essential.

Future Outlook for Adjustable Mortgage Loan Rates Trends

The future of adjustable mortgage loan rates trends depends on inflation, economic growth, and Federal Reserve policy. While no one can predict the future with certainty, several scenarios are plausible for 2024 and beyond.

Predictions for 2024–2025

Most economists expect the Federal Reserve to begin cutting rates in late 2024, assuming inflation continues to moderate. If this happens, adjustable mortgage loan rates trends could stabilize or decline slightly.

- 5/1 ARM rates may fall to 5.5%–6.0% by end of 2024

- Increased ARM adoption expected if rate cuts materialize

- Hybrid ARMs (e.g., 10/1) may gain popularity for longer stability

However, if inflation rebounds, the Fed may pause or even resume hikes, keeping ARM rates elevated.

Long-Term Trends and Market Evolution

Looking beyond 2025, adjustable mortgage loan rates trends may be shaped by structural changes:

- Greater use of SOFR as a transparent, reliable index

- Increased adoption of digital lending platforms offering ARMs

- More borrower education and risk assessment tools

- Potential for ARMs to regain 15–20% market share in favorable conditions

As financial literacy improves and technology enhances transparency, ARMs could shed their post-crisis stigma and become a mainstream option again.

Impact of Technology and Fintech

Fintech companies are transforming how borrowers access and understand adjustable mortgage loan rates trends. Platforms like SoFi, Better.com, and Rocket Mortgage offer real-time rate comparisons, ARM calculators, and personalized advice.

- AI-driven tools predict future payments under different rate scenarios

- Mobile apps provide alerts on rate changes and refinancing opportunities

- Blockchain could improve loan transparency and reduce fraud

These innovations empower borrowers to make data-driven decisions, reducing the risk of surprise rate hikes.

What are adjustable mortgage loan rates trends?

Adjustable mortgage loan rates trends refer to the patterns and changes in interest rates for adjustable-rate mortgages over time. These trends are influenced by economic factors like inflation, Federal Reserve policy, and market demand, and they help borrowers anticipate future payment changes.

Are ARMs a good idea in 2024?

ARMs can be a smart choice in 2024 for borrowers who plan to sell or refinance before the rate adjusts, or those seeking lower initial payments. However, they carry risk if rates rise, so they’re best suited for financially stable individuals with a clear exit strategy.

How often do ARM rates change?

After the initial fixed period (e.g., 5, 7, or 10 years), most ARMs adjust annually. The frequency depends on the loan type—e.g., a 5/1 ARM adjusts once per year after year five.

Can I refinance an ARM to a fixed-rate mortgage?

Yes, you can refinance an ARM into a fixed-rate mortgage at any time, provided you qualify. This is a common strategy to avoid payment increases when the ARM rate resets.

What happens when my ARM rate adjusts?

When your ARM rate adjusts, your monthly payment is recalculated based on the new interest rate, which is determined by the current index value plus your lender’s margin. Rate caps limit how much the rate can increase.

Adjustable mortgage loan rates trends are a dynamic and essential part of the housing finance landscape. From historical lessons to current market conditions and future predictions, understanding these trends empowers borrowers to make informed decisions. While ARMs offer lower initial costs and flexibility, they also come with risks that require careful planning. By monitoring economic indicators, leveraging rate caps, and considering refinancing options, borrowers can navigate the complexities of ARMs successfully. As technology and financial literacy evolve, ARMs may regain broader acceptance, offering a viable alternative to fixed-rate mortgages in the right circumstances.

Further Reading: